Within a couple of weeks of exactly this time two years ago, the lead-in to a blockbuster $4.9 billion M&A deal involving a Japan-based acquirer of a national public homebuilding enterprise practically wrote itself:

“A top-five-ranked U.S. homebuilding company doesn’t happen overnight…. Except when it does.”

That same lead applies to 2026’s supercharged kickoff in homebuilding mergers and acquisitions: the $4.5 billion purchase of top-20-ranked public builder Tri Pointe Homes by Sumitomo Forestry.

In 2024, Sekisui House acquired M.D.C. Holdings, a top-10 public company, for $4.9 billion.

What has not changed are key thematic similarities, including an intensifying race for scale in U.S. new-home construction and development, and the critical importance of geographic and product segmentation diversity.

What’s also emerging in the balance-of-power shift — U.S.-based national public homebuilders vs. overseas-based global construction and real estate conglomerates vs. Clayton — is an escalating X-factor in the race for dominance:

Vertical integration.

This deal, Sumitomo Forestry says without mincing words, is that scale matters, California matters, and the building lifecycle value chain matters.

Unpacking the deal

Sumitomo Forestry and Tri Pointe Homes announced a definitive agreement under which Sumitomo Forestry will acquire Tri Pointe for $47.00 per share in an all-cash transaction valued at approximately $4.5 billion. The purchase price represents an approximately 29% premium to Tri Pointe’s closing stock price on February 12, 2026, and an approximately 42% premium to its 90-day VWAP, and “exceeds” Tri Pointe’s all-time high closing price.

The companies frame the combination as supporting the expansion of U.S. housing supply, accelerating Tri Pointe’s “high-quality homebuilding operations,” and providing homebuyers “a broader array of housing options.”

The transaction is expected to close in Q2 2026, subject to stockholder approval and other customary conditions. It is not subject to a financing condition. Upon completion, Tri Pointe will no longer be listed on the NYSE.

Operational continuity is a central message: Tri Pointe will remain a distinct brand led by its existing team, maintaining its home office in Irvine, CA, its 17 divisions, and its financial services operations.

Not your typical Japan-based firm M&A deal

Sumitomo Forestry’s President Toshiro Mitsuyoshi didn’t bury the lede in his briefing deck. He put it in the strategic rationale.

This acquisition, he said, is “an important step to strengthen the foundation of our U.S. single-family housing business,” one of Sumitomo Forestry’s “core businesses,” accounting for “approximately 60% of our consolidated recurring income.”

Then comes the part that should get every top-tier U.S. builder strategist leaning forward:

With Tri Pointe, Sumitomo Forestry says it will operate at a scale equivalent to the No. 5 homebuilder in the U.S., based on FY2024 units sold, and calls the deal “a major step” toward its stated goal of supplying 23,000 homes annually in the U.S. by 2030 (“Mission TREEING 2030”).

Scale like that has become non-negotiable in U.S. homebuilding. Scale is its own strategic value in a hurry-up, concentrating arena of major players.

And the “what it means” is exactly what Credit Suisse director of housing and building products research Dan Oppenheim put into one short sentence:

“The acquisition of TPH again raises the bar in terms of minimum scale/volume for public builders.”

Oppenheim’s second point is the one that will sting — because it’s not about Tri Pointe’s operations. It’s about how the markets priced them:

“TPH was previously sticking out — profitable, but not trading at a level to be able to access equity, investors worrying about their operations and not wanting them to grow, but definitely a bit too small.”

That is a thesis on the public market’s minimum viable scale for the next cycle. And it’s also a signal to every mid-cap public builder: your valuation, capital access, and growth runway may now be judged against an even harsher benchmark.

Four strategic “why’s” – straight from Sumitomo Forestry

Mitsuyoshi lays out four rationales. They’re unusually direct — and they map exactly to the new consolidation playbook.

1) Scale and management efficiency: the “Top 5” leap

Sumitomo Forestry says the combined FY2024 unit volume (Sumitomo’s U.S. group + Tri Pointe) would total roughly 18,000 units, positioning the combined platform as the fifth-largest homebuilder by closings.

It also says the combined companies will control approximately 114,000 lots, described as about 6.5 years of supply based on FY2024 units sold (using FY12/2025 3Q figures for lots).

This is the “scale as resilience” thesis, expressed numerically.

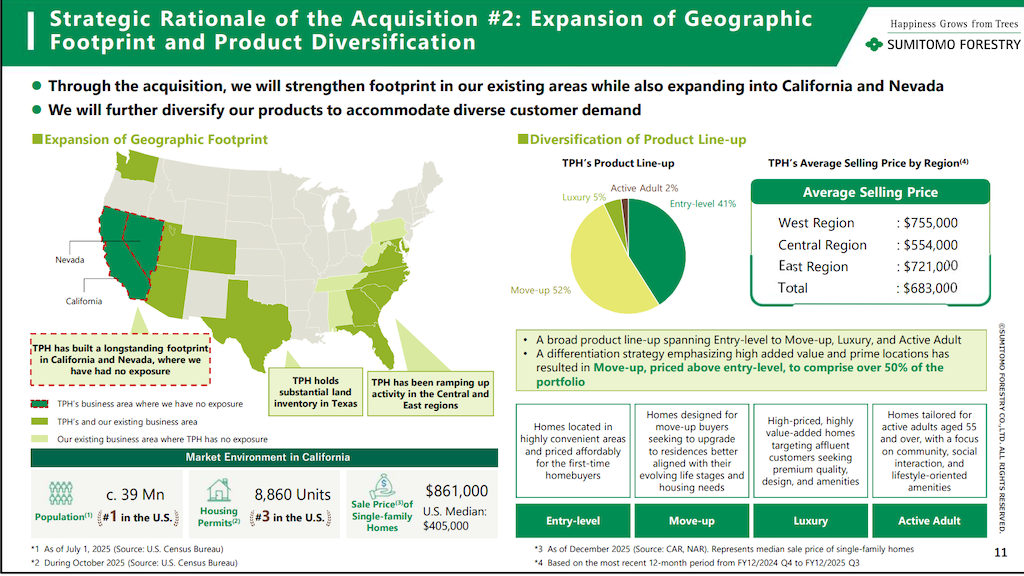

2) California + Nevada: zoning expertise as a strategic strength

Sumitomo is explicit: Tri Pointe was founded in California, a state it describes as defined by “strict zoning regulations” and “constraints,” requiring advanced expertise in land acquisition and architectural design.

And it’s not just about exposure. It’s about capability.

It’s about the arcane game of landing parcels that match customers, price points, product mix, and operational competence, not to mention effectiveness in dealing with localized real estate, local policy, and topographical peculiarities. It’s about being good at making the “hard deals” work.

This is Sumitomo acquiring a platform that operates in areas where land entitlement friction is the product.

3) Product diversification: “premium lifestyle brand” + move-up mix

Tri Pointe’s product lineup in the deck: 41% entry-level, 52% move-up, 5% luxury, 2% active adult.

Sumitomo’s framing is that Tri Pointe’s strength is a “Premium Lifestyle Brand” strategy built on customer-centricity, quality, personalization, and prime locations, with a higher share of move-up buyers.

It also highlights Tri Pointe’s reported 91.7% customer satisfaction rate in 2024, and positions Tri Pointe as maintaining high revenue per unit — stated as approximately $680,000 in FY2024 and described as ranking second among publicly listed U.S. homebuilders.

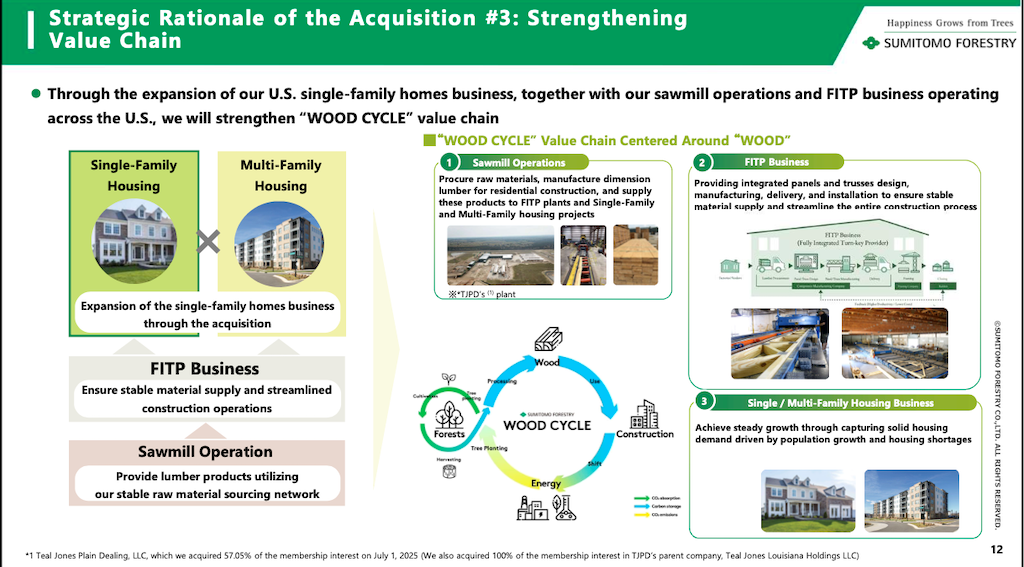

4) The X-Factor: Value Chain Control and the “WOOD CYCLE”

This is where the deal steps into the next era.

Sumitomo describes a U.S. “WOOD CYCLE” value chain spanning sawmill operations, its FITP business (Fully Integrated Turn-key Provider — panels and trusses designed/manufactured/delivered/installed in-house), and downstream single- and multi-family construction.

It states it entered the FITP business in 2022 and established a wall panels and trusses manufacturing plant in North Carolina in 2023, citing labor shortages, rising labor costs, and longer cycle times as drivers.

The message isn’t subtle: downstream scale strengthens upstream economics — and vertical integration is not a side initiative. It’s strategy.

That’s the escalating X-factor in the power balance you previewed in the lead.

Strategic ramp up

This move didn’t come out of nowhere. It builds directly on a strategic trajectory Sumitomo Forestry accelerated in early 2025 when it consolidated Brightland Homes into DRB Group — a move that signaled a shift from decentralized portfolio ownership toward a more unified, vertically integrated U.S. operating platform. At the time, that consolidation marked a pivot from being a capital partner to regional builders to a national enterprise with tighter operational cohesion, clearer leadership structure, and a sharper focus on scale.

The Tri Pointe acquisition now reads less like a standalone transaction and more like the next logical step in that evolution. The DRB-Brightland move concentrated internal platforms and leadership around a nucleus designed to grow toward Mission TREEING 2030’s U.S. delivery targets. Adding Tri Pointe extends that strategy outward — layering on California expertise, higher average price points, and a premium lifestyle positioning that complements Sumitomo’s existing geographic footprint. In effect, Sumitomo has moved from assembling pieces to accelerating integration, reinforcing a model that links upstream manufacturing, downstream homebuilding, and long-range capital strategy into a single operating thesis.

Seen through that lens, the Tri Pointe deal is less about expansion alone and more about momentum. The consolidation of DRB sharpened the organization’s internal spine; this acquisition scales it nationally. What began as portfolio rationalization is now evolving into something closer to a fully articulated American homebuilding enterprise — one built not only on volume growth but on tightening control across the housing value chain.

Capital channels dialed in

Tony Avila, Chairman of Builder Advisor Group, summarizes the deal into two trends that matter most for business leaders:

“This transaction highlights several important trends that we are seeing across the homebuilding sector. First, international capital continues to view the U.S. housing market as an attractive long-term investment opportunity, supported by favorable demographic trends and a structural supply shortage. Second, scale and geographic & product diversification matters in this environment for builders to better navigate volatility and potential disruptions.”

That second sentence is doing a lot of work.

Because this deal is not simply an “M&A event.” It’s an assertion about what kind of platform wins next — and what kind of platform struggles to keep access to capital, land, and strategic optionality.

The takeaways for U.S. homebuilding strategists

The bar is moving. And it’s moving up to a higher level of difficulty.

- A global conglomerate with scale is willing to pay a significant premium for a U.S. public builder platform and take it private.

- The rationale isn’t a single lever. It’s scale, California’s capability, product-mix diversity, and value-chain control.

- And the implication is that mid-cap public builders that “stick out” – profitable yet “too small” in market perception – may increasingly become targets rather than compounding platforms.

The deal also raises the competitive question U.S.-based nationals will have to answer more explicitly in 2026 and beyond:

How do you win a scale race when the other players are not only buying closing volume, but also buying the supply chain?